aktivnoe-mumiyo.ru Tools

Tools

How To Make Money On Buying Stocks

Capital gains are the profits you make from price appreciation. Ideally, your stock will go up in value while you own it, allowing you to sell it for more than. There are three main ways that stock price moves can result in a trading profit. If you buy a stock and its price goes up, when you sell it, the cash proceeds. The first way is when a stock you own appreciates in value - that is, when people who want to buy the stock decide that a share is worth more than you paid for. Investors can cash out stocks by selling them on a stock exchange through a broker. Stocks are relatively liquid assets, meaning they can be converted into. The first way is when a stock you own appreciates in value - that is, when people who want to buy the stock decide that a share is worth more than you paid for. Through every type of market, William J. O'Neil's national bestseller, How to MakeMoney in Stocks, has shown over 2 million investors the secrets to building. There are two possible ways. The first way is when a stock you own appreciates in value - that is, when people who want to buy the stock decide that a share is. Understanding the Basics of Trading · Step 1 Buy low. · Step 2 Sell high. · Step 3 Do not sell in a panic. 4) Stay in cash during a Bear Market. 5) Never argue with the Stock Market; it is always right. 6) Concentrate your stock buying and watch your stocks closely. Capital gains are the profits you make from price appreciation. Ideally, your stock will go up in value while you own it, allowing you to sell it for more than. There are three main ways that stock price moves can result in a trading profit. If you buy a stock and its price goes up, when you sell it, the cash proceeds. The first way is when a stock you own appreciates in value - that is, when people who want to buy the stock decide that a share is worth more than you paid for. Investors can cash out stocks by selling them on a stock exchange through a broker. Stocks are relatively liquid assets, meaning they can be converted into. The first way is when a stock you own appreciates in value - that is, when people who want to buy the stock decide that a share is worth more than you paid for. Through every type of market, William J. O'Neil's national bestseller, How to MakeMoney in Stocks, has shown over 2 million investors the secrets to building. There are two possible ways. The first way is when a stock you own appreciates in value - that is, when people who want to buy the stock decide that a share is. Understanding the Basics of Trading · Step 1 Buy low. · Step 2 Sell high. · Step 3 Do not sell in a panic. 4) Stay in cash during a Bear Market. 5) Never argue with the Stock Market; it is always right. 6) Concentrate your stock buying and watch your stocks closely.

If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments, even small ones. When you buy stocks in a firm, you are given the right to vote in shareholder meetings, receive dividends if and when distributed and also have. Individual stocks are purchased in what is called shares. Buying one or more shares means you own a piece of that company. There are two ways to make money with. In a nutshell: Stocks can help companies and investors make money. For companies, money comes from the payments they receive when investors first buy their. Making money from trading stocks can be achieved through various strategies, but the fundamental idea is indeed to buy low and sell high. Simple. Buy low, sell high. When you buy a stock for $, your expectation is to sell it at a future date for a bit more. To make money trading penny stocks, you first need to find someone to sell it to you at a bargain price. If a company turnaround is expected, a trader is going. When the price of a stock increases enough to recoup any trading fees, you can sell your shares at a profit. These profits are known as capital gains. In. How Much Money Can You Make From Stocks? I have been trading for 17 years, and in my experience, beginners can expect to make 60% per year. And here's how to. The first thing for beginning investors to know about picking stocks is that in the realm of investing, nothing is guaranteed. Index funds. They are the best way to make money in stocks. Index funds put their money in indexes like the S&P or the Russel Index. What to Invest in: Use Your Money to Make Money. By Matthew Frankel, CFP Investing in individual stocks can be a great way to build wealth -- if you. Short selling is a strategy for making money on stocks falling in price, also called “going short” or “shorting.”. Stocks are a type of security that gives stockholders a share of ownership in a company. Companies sell shares typically to gain additional money to grow the. Set orders to buy stock a little at a time, on a regular schedule, or only when it hits your target price. Alerts on market trends. Know what stock has been. The most surefire way to make money in the stock market is to buy shares of great businesses at reasonable prices and hold on to the shares for as long as. Stick with Your Plan: Buy Low, Sell High -- Shifting money away from an asset category when it is doing well in favor an asset category that is doing poorly may. It explains how to: make money reading the daily financial news pages; pick the best industry groups in the market; read charts like an expert to improve stock. Investors buy shares and invest in assets in the hopes of making a profit in the future by either growing their assets or earning an income through dividends. Making Money In The Market There are two basic ways to profit from investing. The first way is to buy stocks or other investments on an exchange, and then.

Borrower Paid Mortgage Insurance

Borrower-paid mortgage insurance (BPMI). This is a monthly premium payment mortgage payment and is the most common type of PMI insurance seen among borrowers. Borrower Paid Split Premium Mortgage Insurance is a type of PMI Insurance that gives you the option of paying part of the MI premium upfront. MGIC offers mortgage insurance Premium Plans to meet your borrower's unique homebuying needs. Compare our borrower-paid and lender-paid MI premiums now. The existence of mortgage insurance allows the borrower to purchase a home with a lower down payment than is normally true. The ability to purchase a home with. Borrowers who want to sidestep paying PMI at closing but don't want to increase their monthly house payment can finance a lump-sum PMI premium into their loan. Mortgage insurance can be either public or private depending upon the insurer. The policy is also known as a mortgage indemnity guarantee (MIG), particularly in. All or a portion of the borrower-purchased mortgage insurance premium (split and single-premium plans) is included in the loan amount. The loan amount including. The Act now protects homeowners by prohibiting life of loan PMI coverage for borrower-paid PMI products and estab- lishing uniform procedures for the. In addition to the annual insurance premiums, borrowers pay an Upfront Mortgage Insurance Premium equal to % of the loan that is typically financed into. Borrower-paid mortgage insurance (BPMI). This is a monthly premium payment mortgage payment and is the most common type of PMI insurance seen among borrowers. Borrower Paid Split Premium Mortgage Insurance is a type of PMI Insurance that gives you the option of paying part of the MI premium upfront. MGIC offers mortgage insurance Premium Plans to meet your borrower's unique homebuying needs. Compare our borrower-paid and lender-paid MI premiums now. The existence of mortgage insurance allows the borrower to purchase a home with a lower down payment than is normally true. The ability to purchase a home with. Borrowers who want to sidestep paying PMI at closing but don't want to increase their monthly house payment can finance a lump-sum PMI premium into their loan. Mortgage insurance can be either public or private depending upon the insurer. The policy is also known as a mortgage indemnity guarantee (MIG), particularly in. All or a portion of the borrower-purchased mortgage insurance premium (split and single-premium plans) is included in the loan amount. The loan amount including. The Act now protects homeowners by prohibiting life of loan PMI coverage for borrower-paid PMI products and estab- lishing uniform procedures for the. In addition to the annual insurance premiums, borrowers pay an Upfront Mortgage Insurance Premium equal to % of the loan that is typically financed into.

Borrower-paid PMI is paid monthly as part of your standard mortgage payments. With this payment method, you generally make payments until you've reached a. Benefits to Lenders – Lender Paid Mortgage Insurance · Borrowers may qualify for a larger loan because of the lower payment · MI premium may be tax-deductible. If you pay less than a 20% down payment on your home, you will have to pay PMI. This is an additional insurance policy that will protect your lender if you are. How to Avoid Paying PMI There's really only two ways a borrower can avoid PMI. These options include: Another option involves Lender-Paid Mortgage Insurance. Borrower-paid mortgage insurance (BPMI) monthly premium options allows homebuyers to fold their MI premiums into their monthly mortgage payments. Although you pay for PMI as the borrower, this insurance doesn't protect you. Instead, it protects the lender. If you default on your mortgage, PMI pays. Mortgage protection insurance pays off the balance of the mortgage in the event that one of the borrowers dies. Some mortgage protection insurance policies also. Private mortgage insurance enables borrowers to gain access to the housing market more quickly, by allowing down payments of less than 20%, and it protects. PMI protects the lender from the risk of loss if you default on your mortgage, and the premiums are typically paid monthly by the borrower. In many cases, PMI. What Is Mortgage Protection Insurance (MPI)? Unlike PMI, MPI protects you as a borrower. This insurance typically covers your mortgage payment for a certain. Find the perfect MI solution for every borrower. Radian offers a diverse line of products, including options for lender-or borrower-paid premiums. The lender makes the payment to the mortgage insurance company, although they will generally pass that cost on to the borrower. Typically, a portion of the. Borrower-paid mortgage insurance, or BPMI, usually costs between % of the overall loan amount annually. If you were to take out a $, mortgage with a. be payable to the lender and your monthly loan payment amount may not change. LPMI differs from borrower-paid mortgage insurance (BPMI) in a number of ways. Choice Monthly Mortgage Insurance, MGIC's premium MI plan, gives borrowers Answers to your Frequently Asked Questions about Borrower paid Choice Monthly. Borrower-paid mortgage insurance (BPMI). This is the most common type of mortgage insurance. You, the borrower, must pay a premium every month until you reach. be payable to the lender and your monthly loan payment amount may not change. LPMI differs from borrower-paid mortgage insurance (BPMI) in a number of ways. A little less common is lender-paid mortgage insurance. This option allows borrowers to avoid the extra cost of PMI in their monthly payments. You would think. Access to the housing market more quickly, by reducing the required down payment · Range of payment options · Cancellation of Borrower-Paid MI (unlike FHA. borrowers really don't understand private mortgage insurance. Known as PMI, private mortgage insurance is to benefit the lender, not the borrower – even though.

Best Merchant Processing For Small Business

Best Credit Card Processing Companies for September · Best Overall: Helcim · Best for Low Transaction Volumes: PayPal · Lowest Fees: National Processing. And that's just the beginning. Small business credit card processing also enables merchants to accept recurring payments for routine orders or subscription. 1. Nadapayments. If your small business wants to cut processing costs and keep more of your revenue, Nadapayments is an excellent choice. The majority of. Merchant Focus can offer you the best credit card processing for small business without it costing you a small fortune. If you've exhausted all other. We have payment processing systems for your small business that can help: Provide secure debit and credit card processing; Manage your business more effectively. Explore merchant services solutions below that seamlessly integrate with your operations and provide secure and efficient payment processing. Who are the largest credit card processors? FIS; Chase Bank; First Data; Bank of America; Global Payments. While age and size can indicate stability and. In this article, we'll discuss the role of merchant service providers, how to pick the right one for your business and share our top picks for you to choose. What's the best credit/debit card processor company for a small business? Square seems fine but any other companies? is it better to have a. Best Credit Card Processing Companies for September · Best Overall: Helcim · Best for Low Transaction Volumes: PayPal · Lowest Fees: National Processing. And that's just the beginning. Small business credit card processing also enables merchants to accept recurring payments for routine orders or subscription. 1. Nadapayments. If your small business wants to cut processing costs and keep more of your revenue, Nadapayments is an excellent choice. The majority of. Merchant Focus can offer you the best credit card processing for small business without it costing you a small fortune. If you've exhausted all other. We have payment processing systems for your small business that can help: Provide secure debit and credit card processing; Manage your business more effectively. Explore merchant services solutions below that seamlessly integrate with your operations and provide secure and efficient payment processing. Who are the largest credit card processors? FIS; Chase Bank; First Data; Bank of America; Global Payments. While age and size can indicate stability and. In this article, we'll discuss the role of merchant service providers, how to pick the right one for your business and share our top picks for you to choose. What's the best credit/debit card processor company for a small business? Square seems fine but any other companies? is it better to have a.

Merchant Service Group provides an array of electronic payment processing options to retail, restaurant, mail order, telephone order, and Internet businesses. Bank of America's Merchant Services offer seamless payment processing services and solutions so you can spend time on what matters most - growing your. Square Point of Sale · Helcim · Intuit QuickBooks Payments · Payline Data · Cayan · Payment Depot · Credit Card aktivnoe-mumiyo.ru · Flagship Merchant Services. Merchant Services for Small Business Owners · ECOMMERCE SOLUTIONS · CLOVER GIFT CARDS · CLOVER CHECK ACCEPTANCE · CLOVER REWARDS · MAIN STREET INSIGHTS · CLOVER. Services like Helcim, Stax and Clover provide robust features, including customer management, employee tracking and management, inventory management, digital. We reviewed dozens of credit card processors for pricing, value-added features, and more. Here are the best ones on the market for your small business. Merchant services cover a wide category of financial services. However, another term regularly used for it is credit card processing. Your business will. In this article, we'll discuss the role of merchant service providers, how to pick the right one for your business and share our top picks for you to choose. Moolah offers clients the best credit card processing for small business, using the Poynt Smart Terminal system for accepting credit, EFTPOS, and debit card. Flagship Merchant Services is a major player in the credit card processing industry. They offer a wide range of features that allow businesses of all sizes. Top picks include household names such as Clover and Square, but also lesser-known gems such as Stax and Merchant One. The Best Credit Card Processing For Small Business · Stax: Best Overall · National Processing: Best For Flat-Rate Pricing · Helcim: Best For International. List of the best payment processors in the USA ; Clearly Payments Logo for Payment Processing. Clearly Payments · aktivnoe-mumiyo.ru ; First Data Payments. Merchant services for small businesses help accept payments from credit card and debit cards. With payment processing tools made to fit your needs. Merchant One has been in business for 20 years, we use state-of-the-art point of sale systems, and offer credit card payment processing solutions. Sky Systemz is a completely customizable cloud platform to accept payments and grow your business! We work with small, medium, and large. Helcim created a great reputation for trustworthiness, transparency, and outstanding customer service by putting you and first prioritizing your success. Easy Pay Direct offers secure and reliable credit card processing solutions for small businesses. Our tailored merchant account services feature advanced fraud. Helcim offers easy, low-cost credit card processing designed for small business Our platform is easy to set up and use, so you can focus on what you do best. Along with credit cards, Clover accepts Google Pay and Apple Pay. Why I picked Clover: For small businesses, cutting down on complexity can save tons of time.

High Quality Queen Sleeper Sofa

Discover the best queen size sofa bed, Noble, at Spaze Furniture. Enjoy premium quality fabric and exceptional comfort for daily use. Shop now! Results list · FRIHETEN Sleeper sofa · FRIHETEN Sleeper sectional,3 seat w/storage · FRIDHULT Sleeper sofa · BÅRSLÖV 3-seat sleeper sofa with chaise · ÄLVDALEN Enjoy the art deco styling with modern materials and functionality with the Nora queen-size sleeper sofa from Apt2B. It's perfect for extra sleeping space! Wrapped in high-quality combination leather and faux leather upholstery that's sure to please. A two-tone effect enhances the depth of color for a uniquely. Stearns & Foster® Giorgio Deep Blue Queen Sofa Sleeper is equipped with a memory foam mattress for luxurious comfort. This top-of-the-line sleeper sofa. At Huffman Koos, we offer a range of high-quality sleeper sofas that are perfect for small spaces, overnight guests, or simply lounging around. Chances are you could find a high end piece that will be marked down. Pay someone to give it a thorough deep clean and you could come in under. Sleepers + Convertible Sofas ; Harley Pull Out Sleeper. $ ; Tropeca Convertible Sofa. $ ; Jonas Queen Sleeper Sofa. $ ; Jonas Full Sleeper Sofa. Ayers Ash (Q): tailored woven texture swatch Arcata Queen Sleeper Sofa, Quick · Drew Linen (Q): textured chenille solid swatch Arcata Queen. Discover the best queen size sofa bed, Noble, at Spaze Furniture. Enjoy premium quality fabric and exceptional comfort for daily use. Shop now! Results list · FRIHETEN Sleeper sofa · FRIHETEN Sleeper sectional,3 seat w/storage · FRIDHULT Sleeper sofa · BÅRSLÖV 3-seat sleeper sofa with chaise · ÄLVDALEN Enjoy the art deco styling with modern materials and functionality with the Nora queen-size sleeper sofa from Apt2B. It's perfect for extra sleeping space! Wrapped in high-quality combination leather and faux leather upholstery that's sure to please. A two-tone effect enhances the depth of color for a uniquely. Stearns & Foster® Giorgio Deep Blue Queen Sofa Sleeper is equipped with a memory foam mattress for luxurious comfort. This top-of-the-line sleeper sofa. At Huffman Koos, we offer a range of high-quality sleeper sofas that are perfect for small spaces, overnight guests, or simply lounging around. Chances are you could find a high end piece that will be marked down. Pay someone to give it a thorough deep clean and you could come in under. Sleepers + Convertible Sofas ; Harley Pull Out Sleeper. $ ; Tropeca Convertible Sofa. $ ; Jonas Queen Sleeper Sofa. $ ; Jonas Full Sleeper Sofa. Ayers Ash (Q): tailored woven texture swatch Arcata Queen Sleeper Sofa, Quick · Drew Linen (Q): textured chenille solid swatch Arcata Queen.

Find the perfect balance between style and comfort with the Queen Sleeper Charisma Linen. With its classic design and high quality materials, this sleeper. A sleeper sofa, also known as a pullout bed, is a couch that can be transformed into a bed. That means you can get the best of both worlds. Discover a great selection of upholstered sleeper sofas, loveseats and sectionals with Twin, Full or Queen size mattresses. Customizable upholstered sleeper sofa built with a dual motion sleeper mechanism, allowing you to sit, sleep, or do both simultaneously. King, Queen. I'd really just like to get a replacement queen sleeper sofa that's good quality and will last (hopefully something under $2k). Best Home Furnishings Customizable Bayment Queen Sleeper with Pillows. 77” W x ” D x 34” H. On Display at: Hudsonville, Holland, Byron Center. Enjoy this comfortable queen-size sleeper sofa. Durable, cleanable microfiber material on the outside of the sofa, and a stylish Northwoods Print on the inside. When you buy a sleeper sofa from Ivan Smith, you can rest assured knowing that you're getting a high-quality piece of furniture. We only. The top-selling product within Queen Sofa Beds is the Serta Augustus in. Java Polyester 3-Seater Queen Sleeper Convertible Sofa Bed with Square Arms. Does. Your finest sofa, their best night's sleep! The Pearson Comfort Sleeper has clean, simple lines that mix with any home decor, and no one will ever guess there's. Make room for overnight guests with our modern sleeper sofas. Whether you need a sprawling king sectional or a cozy twin chair, find comfortable and stylish. Neylory " Queen Pull Out Sofa Bed, 3 in 1 Convertible Sleeper Sofa. Our Queen Sleepers can be ordered in a wide assortment of fabrics or leathers. Check out our Quick-Ship Gallery for our selection of Queen Sleepers. To those who want sleeper sofas or sofa bed that are great to sit in, most comfortable to sleep in, with Cushie Sleeper Sofa, you can now have it for less. Best® Home Furnishings Customizable Caverra Queen Sleeper Sofa ; Seating Capacity, 3 ; Color Finish Name, Available in a Variety of Colors ; Product Weight (lbs.). Shop Wayfair for the best queen size sofa bed. Enjoy Free Shipping on most stuff, even big stuff. Sandra Queen Sleeper (Performance fabrics). Starting At$2, By Craftmaster Furniture high-quality convertible sofa bed sectional for your home. A basic. Harris Queen Sleeper Sofa (74"); undefined 1 Best Seller. Harmony Modular Sleeper Sofa (85"). Harmony Modular Sleeper. Sleeper sofa beds and couches are great when you're short Best Matches. Product Name Ascending. Product Name Descending. Availability. Price, Low to High. Some of the reliable sofa brands from which you can buy queen sleeper sofas are Luonto, Kathy Ireland, Enza Home, Gio Italia, Bernhardt, and Universal Furniture.

What Can Build Your Credit

How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. Paying your bills on time is the most important rule of thumb when it comes to generating good credit. Your payment history accounts for 35% of your total. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. Most lenders will allow someone with an established credit history -- like your parents, older siblings or a family friend -- to co-sign the credit application. Start small with what you can comfortably pay each month along with your other obligations. Learn more about credit scores. Explore more resources about. You can build credit by using your credit card and paying on time, every time. Pay off your balances in full each month to avoid paying finance charges. Paying. Apply for a secured credit card · Become an authorized user · Get credit for paying monthly bills on time · Take out a credit-builder loan · Keep a close eye on. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. But. How to Build Good Credit · Review your credit reports. · Get a handle on bill payments. · Use 30% or less of your available credit. · Limit requests for new credit. Paying your bills on time is the most important rule of thumb when it comes to generating good credit. Your payment history accounts for 35% of your total. Review your credit report · Create a plan · Consider a debt consolidation loan or balance transfers to a lower rate credit card · Research working with a credit. Most lenders will allow someone with an established credit history -- like your parents, older siblings or a family friend -- to co-sign the credit application. Start small with what you can comfortably pay each month along with your other obligations. Learn more about credit scores. Explore more resources about. You can build credit by using your credit card and paying on time, every time. Pay off your balances in full each month to avoid paying finance charges. Paying. Apply for a secured credit card · Become an authorized user · Get credit for paying monthly bills on time · Take out a credit-builder loan · Keep a close eye on. How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts. · Keep. There are several ways you can improve your credit score, including making on-time payments, paying down balances, avoiding unnecessary debt and more. But.

But if you establish a good credit score, you can save money on interest payments and use the savings to invest in your future. Credit also influences more than. Once you have your credit card put your cheapest online subscription on that card. And set up the card for automatic payments. This is the best. Most lenders will allow someone with an established credit history -- like your parents, older siblings or a family friend -- to co-sign the credit application. Make sure the credit company reports your payment history so it will improve your credit rating. Interest rates on secured cards tend to be higher than. One of the fastest ways to build good credit is by paying your bills on time. Creditors like to see a solid track record of responsibility. If you miss a. Paying your electric, cell phone, water, or Internet bills them with your credit card can boost your score in two ways: First, if you enroll in an autopay. Credit cards to help build or rebuild credit can create a successful financial future when handled responsibly. See more. A good credit score helps you qualify for loans and lower interest rates when you borrow. This will help you buy a car, get a mortgage, pay for school, qualify. He helped me build my credit and I am in debt to him forever. After 6 months of not looking I check it today just to see what would happen after getting. ⁴ BuildMyCreditScore reports both on-time and late payments, which can affect your credit score. Credit scores are determined independently by credit reference. Your payment history plays a large role in determining your credit score · Try to keep your balances below 30 percent of your total available credit · Keeping. 8 ways to build your credit without a credit card · 1. Get a Credit Builder Loan · 2. Use KOHO's Credit Building Option · 3. Report Regular Payments to Credit. Normally, these bills only show up on your report if you don't pay them on time. Adding them to your report is proactive and can help build your credit. Just. Start Slow. Good credit takes time to build. · Get a Student Credit Card. Many financial institutions offer credit cards designed especially for students, which. Apply for a credit card Used wisely, credit cards can speed up the process of building your credit. If you don't have enough credit history to get a regular . Best way to build credit? · Pay it off every montha. · As another poster said, don't use more than 30% of your limit even better if you can keep. If someone with a good credit score is willing to co-sign a loan, and you repay the borrowed money, that will build your credit score. Not everyone will be. Paying your bills on time is the most important rule of thumb when it comes to generating good credit. Your payment history accounts for 35% of your total. Step users can build credit history for up to two years before turning We do not have control over your credit scores generated by the credit bureaus. Make sure the credit company reports your payment history so it will improve your credit rating. Interest rates on secured cards tend to be higher than.

Does It Cost Money To Meet With A Financial Advisor

In a fee-based arrangement, you would pay a total amount based on the value of assets being managed. It can provide some transparency and a direct line of sight. Often the decision to consult with an advisor is triggered by a life change, such as buying a home, inheriting money or starting a family. A good advisor always. What Does a Commission-Based Financial Advisor Cost? A commission-based financial advisor doesn't cost you anything—directly, that is. They get compensated by. However, fee-based planning services are optional, offered separately, and priced according to the complexity of your financial situation. This is a structured. Good independent advisors charge $+/hour for advice. Why would they give it away for free? Thats like asking a lawyer or dentist to do free work. 85%, but for anything under $,, the fee may jump to %. Some charge more if they have more experience or credentials to point to. Every advisor is. The cost of hiring a financial advisor varies significantly based on the services provided. While paying a 1% fee is common, you should consider additional. When we make big decisions in life, most of us look for a source of expertise and guidance to help us make thoughtful choices to meet our individual goals and. Is there anything I haven't considered? How do these goals affect me financially? Understanding your investment personality. Once we understand your hopes and. In a fee-based arrangement, you would pay a total amount based on the value of assets being managed. It can provide some transparency and a direct line of sight. Often the decision to consult with an advisor is triggered by a life change, such as buying a home, inheriting money or starting a family. A good advisor always. What Does a Commission-Based Financial Advisor Cost? A commission-based financial advisor doesn't cost you anything—directly, that is. They get compensated by. However, fee-based planning services are optional, offered separately, and priced according to the complexity of your financial situation. This is a structured. Good independent advisors charge $+/hour for advice. Why would they give it away for free? Thats like asking a lawyer or dentist to do free work. 85%, but for anything under $,, the fee may jump to %. Some charge more if they have more experience or credentials to point to. Every advisor is. The cost of hiring a financial advisor varies significantly based on the services provided. While paying a 1% fee is common, you should consider additional. When we make big decisions in life, most of us look for a source of expertise and guidance to help us make thoughtful choices to meet our individual goals and. Is there anything I haven't considered? How do these goals affect me financially? Understanding your investment personality. Once we understand your hopes and.

But how could a dedicated financial advisor help you achieve more? Answer 3 Diversification of investments, low-cost funds, and tax-efficient. This all depends on how much you feel you want to loose. financial planners are not cheap! they can be a necessary if you are totally. Your initial consultation is completely free. After that, any costs would depend on the kinds of services you use and the complexity of your portfolio. The cost can equate to a couple thousand dollars a year or more. Others charge a percentage of the money they manage for you. Those fees, called assets. “There are also financial planners who will charge a fee just for the financial plan or charge an hourly fee if you need advice on a particular goal or to. A fee-only advisor can cost you a lot more money upfront. If your advisor charges an hourly rate of $, and it takes them five hours for your first meeting to. For instance, if you want to pay off a mortgage, buy property, or give money away, a flat-fee advisor will not lose revenue. So, how much does it cost to work. Match with Financial Advisors personalized for you. Consultations are complimentary. Take the quiz. Search for a Financial Advisor. Search By. How much does a financial adviser charge? Many financial advisers offer an initial meeting free of charge. This isn't designed to give you specific advice. Mixed Compensation: Fee-based advisors can earn money through a mix of fees paid directly by clients and commissions from selling financial. A financial advisor is a neutral third-party, and should be able to give your current budget a look without judging you -- or even help you create one for the. At Schwab, there's no cost to work with your Financial Consultant.² · Pay only for the products and services you choose. · How can I get access to a Financial. Some advisors require you to bring a minimum amount of money to invest to use their services. Depending on the advisor, it could range from $20, to over $1. Meeting a financial advisor is an opportunity for you to ask questions, talk about your long-term goals and current priorities and get to know each other. You pay a commission when you buy and sell certain investments. Some investments, such as mutual funds, may also have internal expenses in addition to a sales. Your first meeting with an Ameriprise financial advisor is always free, but what costs and fees can you expect when working with an advisor? Learn more. Financial advisers have a variety of ways of charging you for their services, so it is important to ask your adviser at your first meeting how they charge, at. Some advisors charge an annual fee that's a percentage (typically 1%) of how much money they manage for you. Other fee structures include: Fee only – The. Depending on their fee structure, you may have to pay a retainer or additional fees as compensation. Some financial advisors have flat fees for their services. Financial advisors can provide valuable advice about money that helps you reach your financial goals. Of course, this advice isn't free. Financial advisors.

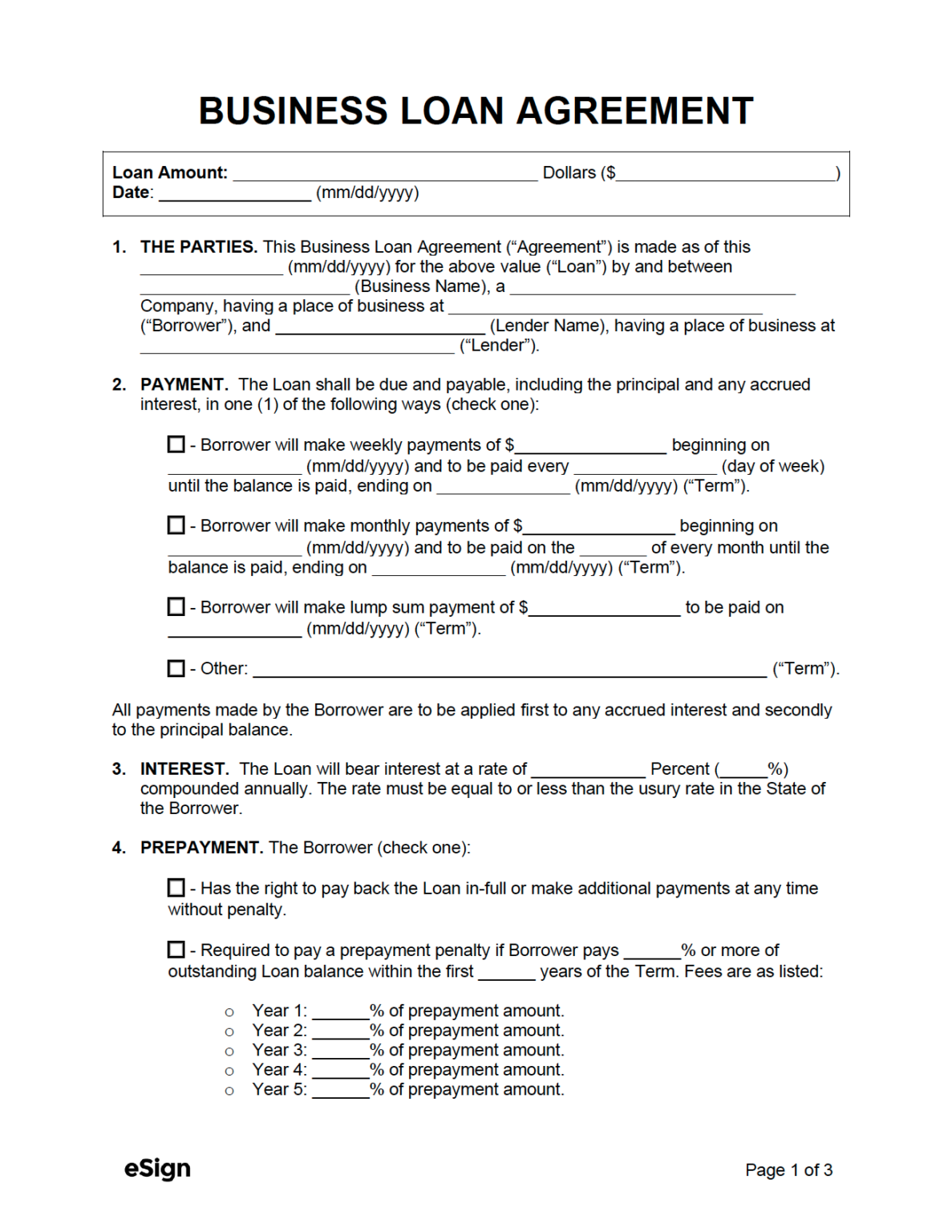

Commercial Loan For Llc

Secured business line of credit ; Loan amount: From $25, ; Interest rate: As low as % ; Loan terms: revolving with annual renewal ; Qualifications: Minimum 2. While there aren't typically any state grants available for small-business startups, there are many lending opportunities. Below is Georgia's list of. An LLC business loan is a type of financing specifically for businesses structured as Limited Liability Companies. You can use an SBA loan to buy, construct or improve commercial real estate or to purchase heavy equipment. Our commercial mortgage loan platform targets mostly opportunities in the primary markets with the remainder in select secondary and tertiary markets. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit. Visit Wells Fargo online or visit a store to. Business owners can also use commercial loans to cover day-to-day business expenses. For example, a commercial loan can support cash flow when income is. Borrow up to $50, for whatever you need for your business—no collateral required and no financial statements or liquidity verification for eligible requests. Although it is recommended that you hold real estate in an LLC, it is not required that the property be held in an LLC as long as you can demonstrate that the. Secured business line of credit ; Loan amount: From $25, ; Interest rate: As low as % ; Loan terms: revolving with annual renewal ; Qualifications: Minimum 2. While there aren't typically any state grants available for small-business startups, there are many lending opportunities. Below is Georgia's list of. An LLC business loan is a type of financing specifically for businesses structured as Limited Liability Companies. You can use an SBA loan to buy, construct or improve commercial real estate or to purchase heavy equipment. Our commercial mortgage loan platform targets mostly opportunities in the primary markets with the remainder in select secondary and tertiary markets. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit. Visit Wells Fargo online or visit a store to. Business owners can also use commercial loans to cover day-to-day business expenses. For example, a commercial loan can support cash flow when income is. Borrow up to $50, for whatever you need for your business—no collateral required and no financial statements or liquidity verification for eligible requests. Although it is recommended that you hold real estate in an LLC, it is not required that the property be held in an LLC as long as you can demonstrate that the.

Best for businesses that want an unsecured term loan, with a simplified application and decisioning process. The loan program provides long-term, fixed rate financing for major fixed assets, such as equipment or real estate. loans are available through. This can be anything from your LLC operating or franchise agreement to your current commercial lease or commercial real estate purchase agreement. You may also. The loan program provides long-term, fixed rate financing for major fixed assets, such as equipment or real estate. loans are available through. Our SBA-backed loans can help you expand a business, purchase or improve commercial real estate, fund new inventory, or purchase new equipment. We offer financing for long-term, permanent commercial real estate loans, whether it's for your own business or investment and owner-occupied or non-owner-. Hybrid Flex Loan. Flexibility to finance various assets such as equipment, vehicles, or machinery with a short-term line of credit that turns into a term loan. Our suite of small business financing solutions can help your business reach new heights. From building a fleet and improving cash flow to renovating office. Hybrid Flex Loan. Flexibility to finance various assets such as equipment, vehicles, or machinery with a short-term line of credit that turns into a term loan. The Small Business Loan Guarantee program helps businesses create and retain jobs, and encourages investment in low- to moderate-income communities. The Small. Commercial loans typically range from five years or less to 20 years, with the amortization period often longer than the term of the loan. Commercial loan loan-. Our suite of small business financing solutions can help your business reach new heights. From building a fleet and improving cash flow to renovating office. The Illinois Department of Commerce & Economic Opportunity offers low-interest loan programs to help your business. Advantage Illinois provides low interest. Wells Fargo has something for any small business, including business credit cards, loans, and lines of credit. Visit Wells Fargo online or visit a store to. Bank of America financing guaranteed by the SBA may be right for your business. SBA (suitable for commercial real estate loans of $, and above), SBA 7. Borrow up to $50, for whatever you need for your business—no collateral required and no financial statements or liquidity verification for eligible requests. What is required for a small business loan? · Number of years in business: Some lenders may have tenure requirements to meet before you can apply or be approved. Chase Business Line of Credit Annual Fee: % of line ($ min; $ max). Fee can be waived if average utilization over the year is 40% or higher. Chase. U.S. Bank business loan options can be used to cover operating expenses, maintain inventory, pay vendors and more. Backed by the strength and stability of.

Physician Personal Line Of Credit

Laurel Road for Doctors offers personal loans specifically for residency or a fellowship. As a Resident or Fellow you can pay as little as $25 per month. PhysicianLoans is powered by Huntington. Together, we can help prescribe the right loan for you – whether you're a graduating medical student or a. With rates less than half the average credit card rate and quick funding, a PRN Personal Loan for Physicians can help you with: Home Improvements, Credit Card. 5 The SunTrust Bank Physician Line of Credit is only available in AL, AR, FL • Unsecured loans to help with personal expenses, cover unexpected costs, and. A Physician Line of Credit can offer easy cash access for interns, residents, and fellows to manage personal expenses so they can focus on what matters. Our solution: A mortgage program designed to help make homeownership easy and affordable for medical professionals including physicians, pharmacists. Personal Loans · Financing up to $, · Flexible repayment terms · Quick financing decisions. A physician loan is a mortgage solution designed to accommodate the unique financial needs of doctors, dentists, veterinarians and medical residents. Personal Loans For Doctors & Dentists · A loan of up to $, · A fixed rate loan for 3 or 5 years. · A variable rate line of credit for 2 years · The potential. Laurel Road for Doctors offers personal loans specifically for residency or a fellowship. As a Resident or Fellow you can pay as little as $25 per month. PhysicianLoans is powered by Huntington. Together, we can help prescribe the right loan for you – whether you're a graduating medical student or a. With rates less than half the average credit card rate and quick funding, a PRN Personal Loan for Physicians can help you with: Home Improvements, Credit Card. 5 The SunTrust Bank Physician Line of Credit is only available in AL, AR, FL • Unsecured loans to help with personal expenses, cover unexpected costs, and. A Physician Line of Credit can offer easy cash access for interns, residents, and fellows to manage personal expenses so they can focus on what matters. Our solution: A mortgage program designed to help make homeownership easy and affordable for medical professionals including physicians, pharmacists. Personal Loans · Financing up to $, · Flexible repayment terms · Quick financing decisions. A physician loan is a mortgage solution designed to accommodate the unique financial needs of doctors, dentists, veterinarians and medical residents. Personal Loans For Doctors & Dentists · A loan of up to $, · A fixed rate loan for 3 or 5 years. · A variable rate line of credit for 2 years · The potential.

Typically you can expect to be loaned % up to $1 million and up to 90% for a $2 million loan amount. Special Treatment of Student Loans: Even if you have. Physician line of credit · $50, max line amount for medical residents and fellows · $, max line amount for board-certified physicians, dentists, and. Through our Medical and Dental Professional Loan Program* you will enjoy: 3/1, 5/1 and 7/1 adjustable rate loan terms; No down payment on loans up to $, Physician mortgage loans, or doctor loans, are mortgage loans geared explicitly to medical professionals. Recent med-school graduates, doctors, and dentists in. With BHG Financial, doctors and physicians can use personal or commercial loans to pave the path forward for their lives and careers. Laurel Road for Doctors offers personal loans customized for physicians and dentists. Practicing doctors and dentists can borrow up to $ Mortgage loans of up to $ for new or established physicians with $0 down payment, fixed rate, and no private mortgage insurance required. Personal Loans for Physicians. Realize your ambitions with loans only doctors can access, empowering physicians from training to practice. Explore Personal. At Regions Bank, any medical physician, including residents, fellows, doctors of dental medicine and doctors of osteopathy, can apply for a mortgage through. With a business line of credit, a medical professional is approved to borrow up to a certain amount of money and can draw funds as needed. When a medical. Access personal loans tailored for physicians with Doc2Doc Lending. Get flexible financing to meet your professional and personal financial needs. Physician Bank is excited to help empower your financial goals with Personal Loans1 for Physicians. Your private banker will work with you to personalize a loan. A line of credit is a good solution for a physician's short-term funding needs. You can use a business line of credit to purchase equipment, meet immediate. Physician Mortgage Loans Our programs provide new and established doctors (MD, DO, DPM, DDS, DMD, DVM, and OD) with targeted benefits and simple solutions to. An Interest-only payment option is available on Medical start-up loans. On project-related loans, a dedicated project manager will be assigned to make payments. Medical Providers Get Fast Easy Financing. Doctor, Physician, Dentist, Veterinarian, Optometrist & Healthcare Professional Loans. Grow with Hippo Lending! Physician Home Loans from Advantis Credit Union are designed for new doctors looking to buy their first home. Banks are for Profit. Advantis is for You. Our Physician Mortgage Loans Feature: · Up to 95% financing for home purchases. · No private mortgage insurance required. · Competitive pricing on fixed and. Plus, the Flexible Physician Loan Program offers loan amounts of up to $1 million, down payment options of less than 20%, and no Private Mortgage Insurance. With a Physicians Loan, you are able to come to closing with no down payment and get up to % financing1 without paying private mortgage insurance (PMI).

Can You Use A 401k As Collateral For A Loan

A qualified plan may, but is not required to provide for loans. If a plan provides for loans, the plan may limit the amount that can be taken as a loan. The. The current prime rate is %, so your (k) loan rate would be from % to %. Your credit score doesn't affect the interest rate, which is one reason. The Internal Revenue Service (IRS) does not allow (k) participants to use their retirement accounts as collateral for a loan. k. You can estimate a loan payment using our loan calculator or obtain additional information regarding loans at aktivnoe-mumiyo.ru Debt is Debt. The purpose of. You can use a LMA account as a cost-effective way to meet a variety of short You can lose more funds than are held in the collateral account. The. In effect, you actually use your own retirement savings as collateral for the loan. All plans have loan policies, including minimum and maximum amounts you can. No. A (k) account cannot be pledged as collateral, other than as security for certain loans from the plan. Any legitimate lender would know. That's not allowed for K nor for an IRA. IRS would treat it as if you did a full disbursement of your retirement fund. You can receive a plan loan or a. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans. A qualified plan may, but is not required to provide for loans. If a plan provides for loans, the plan may limit the amount that can be taken as a loan. The. The current prime rate is %, so your (k) loan rate would be from % to %. Your credit score doesn't affect the interest rate, which is one reason. The Internal Revenue Service (IRS) does not allow (k) participants to use their retirement accounts as collateral for a loan. k. You can estimate a loan payment using our loan calculator or obtain additional information regarding loans at aktivnoe-mumiyo.ru Debt is Debt. The purpose of. You can use a LMA account as a cost-effective way to meet a variety of short You can lose more funds than are held in the collateral account. The. In effect, you actually use your own retirement savings as collateral for the loan. All plans have loan policies, including minimum and maximum amounts you can. No. A (k) account cannot be pledged as collateral, other than as security for certain loans from the plan. Any legitimate lender would know. That's not allowed for K nor for an IRA. IRS would treat it as if you did a full disbursement of your retirement fund. You can receive a plan loan or a. Loans are not permitted from IRAs or from IRA-based plans such as SEPs, SARSEPs and SIMPLE IRA plans. Loans are only possible from qualified plans.

Yes, you can borrow from your (k) plan to start a business, but only if your program administrator allows you to take out a loan. Line of credit considerations: Like a HELOC, this is a variable rate loan. You also can't use line of credit funds to buy investment securities, or repay. A (k) loan works much like a personal loan, except you're borrowing from your retirement account instead of a lender. While some plans may allow you to take out more than one loan from your (k) at a time, if you do, the amount you can borrow will be reduced. For example, if. Your (k) plan may allow you to borrow from your account balance. However, you should consider a few things before taking a loan from your (k). before submitting an application for a loan. Do I have to put up collateral and qualify for a loan in the same way I would at a bank? No. How are loans. What it is: Just as a bank can allow you to borrow against the equity in your home, your brokerage firm can lend you money against the value of eligible stocks. No. A (k) account cannot be pledged as collateral, other than as security for certain loans from the plan. Any legitimate lender would know. And you can possibly avoid early withdrawal penalties and taxes if you're under 59 ½. You can take out as much as 50% of your vested account balance, up to a. And you can possibly avoid early withdrawal penalties and taxes if you're under 59 ½. You can take out as much as 50% of your vested account balance, up to a. To take out a loan, you'll first need to check if your plan even allows it. If so, you can request a loan from your plan administrator. According to Fidelity. What it is: Just as a bank can allow you to borrow against the equity in your home, your brokerage firm can lend you money against the value of eligible stocks. Using your securities to borrow money. You can use securities as collateral for a loan. Here's what you need to know. Fidelity Learn. (k) loans allow borrowers to temporarily withdraw funds from their (k) account and use the money to cover certain expenses. Then the actual amount you'll receive is $9, If you're eligible for a Collateralized Loan: The minimum loan amount is $1, or an amount specified by your. A (k) loan works much like a personal loan, except you're borrowing from your retirement account instead of a lender. Money withdrawn from your (k) account will not be earning interest, so your retirement savings might not grow at the same rate. Using a personal loan to. Texa$aver allows a maximum of two loans per Plan. Examples: If your balance is $1,–$10,, you may borrow the entire balance (as long as the $50 loan. If you take out a line of credit with the Bank(s), the collateral securing your loan will be held in your account(s) subject to the terms of the Control. 1.) Will the money fix the problem? Many borrowers use money from their (k) to pay off credit cards, car loans and other high-.

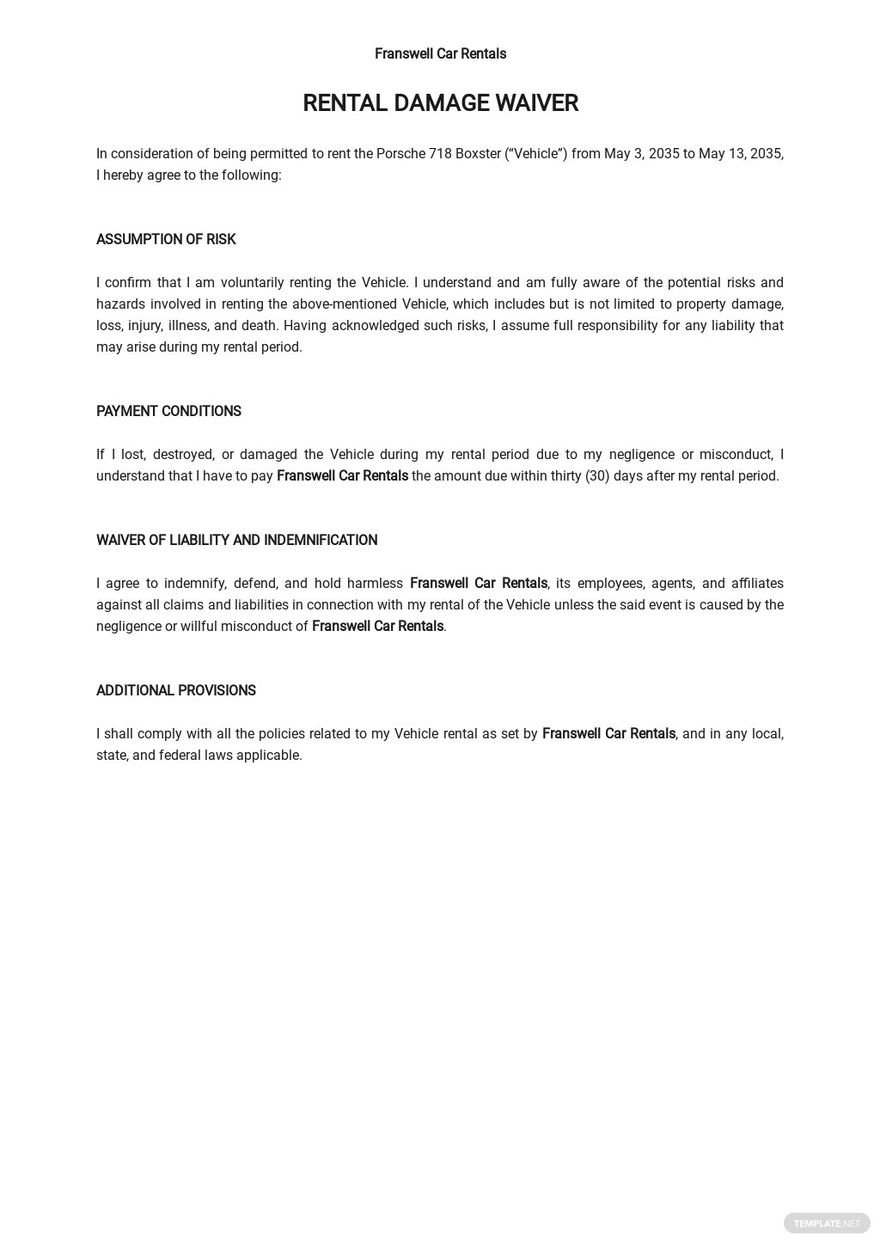

Credit Card Auto Rental Collision Damage Waiver

When you use your Visa card to book a car and pay the full price of the rental, you are covered by this insurance. · To access this coverage you must decline the. You must decline the optional collision/damage waiver (or similar coverage) offered by the rental company. You must rent the vehicle in your own name and sign. Auto Rental Collision/Loss Damage Insurance (CLDI) is for rentals up to 48 days; and the car rental company's Collision Damage Waiver (CDW) or Loss Damage. Auto Rental Collision Damage Waiver reimburses You for damages caused by theft or collision -- up to the Actual Cash Value of most rented cars. By reserving and paying for a vehicle rental with an eligible Visa card, you'll be covered for Accidental Damage and Total Theft of the Rented Vehicle for. Credit card car rental insurance typically provides coverage for damage to or theft of a rental vehicle. It may also offer liability coverage for bodily injury. The simplest solution is to buy a CDW supplement from the car-rental company. This coverage technically isn't insurance — it's a waiver. Auto Rental Collision Damage Waiver — Decline the rental company's collision insurance and charge the entire rental cost to your card. Auto Rental Collision Damage Waiver covers theft, damage, valid loss-of-use charges imposed and substantiated by the auto rental company, administrative fees. When you use your Visa card to book a car and pay the full price of the rental, you are covered by this insurance. · To access this coverage you must decline the. You must decline the optional collision/damage waiver (or similar coverage) offered by the rental company. You must rent the vehicle in your own name and sign. Auto Rental Collision/Loss Damage Insurance (CLDI) is for rentals up to 48 days; and the car rental company's Collision Damage Waiver (CDW) or Loss Damage. Auto Rental Collision Damage Waiver reimburses You for damages caused by theft or collision -- up to the Actual Cash Value of most rented cars. By reserving and paying for a vehicle rental with an eligible Visa card, you'll be covered for Accidental Damage and Total Theft of the Rented Vehicle for. Credit card car rental insurance typically provides coverage for damage to or theft of a rental vehicle. It may also offer liability coverage for bodily injury. The simplest solution is to buy a CDW supplement from the car-rental company. This coverage technically isn't insurance — it's a waiver. Auto Rental Collision Damage Waiver — Decline the rental company's collision insurance and charge the entire rental cost to your card. Auto Rental Collision Damage Waiver covers theft, damage, valid loss-of-use charges imposed and substantiated by the auto rental company, administrative fees.

The collision damage waiver or loss damage waiver offered by the rental car company means that if your rental car is damaged or stolen, you don't have to pay to. The Auto Rental Collision. Damage Waiver acts as primary coverage and covers theft, damage, valid loss-of-use charges imposed and substantiated by the auto. Auto Rental Collision Damage Waiver. This coverage reimburses You if a covered accident or theft occurs to the Rental Car. To be eligible for coverage, the. damages caused by theft or collision – up to the Actual Cash Value of most rented cars. Auto Rental Collision Damage Waiver covers no other type of loss. For the coverage to be applicable, the Cardholder must decline the Collision Damage Waiver (CDW) or similar coverage offered by the auto rental company. You must decline the optional collision/damage waiver (or similar coverage) offered by the rental company. You must rent the vehicle in your own name and sign. Auto Rental Collision Damage Waiver reimburses You for damages caused by theft or collision — up to the Actual Cash Value of most rented cars. To take advantage of it, you usually have to pay for the rental car using the card and rent the car in your name. Credit cards typically cover physical damage. Provided the full cost of the rental is charged to your eligible CIBC card, Car Rental Collision / Loss Damage Insurance covers you for theft, loss and damage. This coverage may be called an “Auto Rental Collision Damage Waiver” and is not quite insurance but a waiver of fees. Unlike insurance, it's likely not. No matter what happens to Your rental car, You can be covered with Auto Rental Collision Damage Waiver. Auto Rental Collision Damage Waiver reimburses You for. This coverage may be called an “Auto Rental Collision Damage Waiver” and is not quite insurance but a waiver of fees. Unlike insurance, it's likely not. Getting into your Rental Vehicle can be the start of a great vacation. When you use your Eligible Card to reserve and pay for the Entire Rental and decline. Review the auto rental agreement and decline the rental company's collision damage waiver (CDW/LDW) option, or a similar provision, as accepting this coverage. Collision damage waivers only cover damage to the rental car. They don't cover liability-related expenses. Additionally, collision damage waivers may not cover. Your Auto Rental Collision Damage Waiver benefit acts as primary coverage and covers theft, damage, valid loss-of- use charges imposed and substantiated by the. To take advantage of it, you usually have to pay for the rental car using the card and rent the car in your name. Credit cards typically cover physical damage. However, changes in the law give renters the option of purchasing a CDW, also known as Optional Vehicle Protection (OVP) from the rental vehicle company, and. Platinum Card® from American Express · American Express® Gold Card · American Express® Green Card · Cash Magnet® Card · Blue Cash Everyday® from. American Express. Buying CDW coverage means that the rental company waives their right to hold you responsible for any accidental damage to the car. If you do not purchase the.

1 2 3 4 5 6